Title:

Bank Islam Malaysia Berhad (BIMB)

Prepared for:

PM Hajah Rosmadah

Prepared by:

Syahida Bt Abd Aziz 2011253056

Nur Atiqah Bt Ibrahim 2011674814

Haulah Bt Abd Aziz 2011203594

Group: BMB5Ad

Due date: 21st December 2012

September 2012 – January 2013

Bachelor of Business Administration (Hons) Marketing

Faculty of Business Management

Universiti Teknologi MARA Perlis,

02600 Arau, Perlis.

ABSTRACT

This study was carried out to know about the banking industry which includes their management and marketing strategies to improve the performance of the business. This information regarding the service provided has been obtained through various reading on the respective bank’s website. The chosen bank for the company analysis is Bank Islam Malaysia Berhad which also known as BIMB.

The process of seeking information has been done by viewing and browsing through the bank’s website. Overall findings from the surfing internet it indicates that Bank Islam provide the best service to its customers and it can be proven when Bank Islam get awarded as the Best Islamic Bank in Malaysia in the year 2011. Based on the information get from the internet it shows that the service gets from the BIMB is not a seasonal service but it operates in daily basis which means people are seeking to get this service every time they want.

Besides, BIMB always use different strategies in order to get a large number of customers who use their bank in the process of borrowing or transferring the money. These strategies are using different types of mass media to expose their service information to their new customers who have no experience in using their company’s service yet. There are several internal and external factors which affect the industry of banking which being explain further in the report.

In conclusion, some recommendations have been made to increase the awareness of new customers about BIMB and maintain the existence of their existing customers. These recommendations have been included in the final part of the report.

ACKNOWLEDGEMENT

Alhamdulillah to Allah S.W.T because of His blessing, we finally finished this assignment. Therefore, we would like to take this opportunity to thank our Strategic Management lecturer, PM Hajah Rosmadah who always teach us, guide us, and inspire us from the beginning until the end of the assignment.

Besides that, we would like to thank our colleagues for giving full co-operation and commitment through all the way. Friends, all your brilliant ideas and suggestions really helped us a lot. I also want to convey to my gratitude to Perpustakaan Dato’ Jaafar Hassan for the availability of good reference books that really helped us in completing this assignment. This assignment is very interesting and nice to work with and we try to do it very well and as best as we can.

And lastly, we would like to thank specially to our parents for their efforts in finishing this exciting assignment. They are willing to contribute, in term is time, money, energy and others. Without their help and contribution, this assignment will not be complete successfully as it is now. Thanks a lot and may Allah S.W.T bless all of you.

INTRODUCTION TO INDUSTRY

Bank Islam Malaysia Berhad (BIMB) is a financial institution in Malaysia. Nowadays, people tend to use the bank as for their place to keep their money. This is because of a high level of safety being imply on their asset such as their case money. Only the best bank with high quality and customers service can survive and beat other newly grow and exist banks in the market. BIMB is the first Islamic bank in Malaysia which was incorporated as a public company in March of 1983 (UAE, 2011).

Attracted to the above phenomena, we have chosen Bank Islam Malaysia Berhad as one of the best Islamic banks in Malaysia. In the year 2011, BIMB has been awarded as the Fourth Best Islamic Bank in Malaysia. Besides, Bank Islam has ranked Fourth Strongest Bank in Malaysia by the Asian Banker. Therefore, this report is discussing the company analysis which includes its business segment, critical success factors, internal and external environment, the problem facing by the bank and the strategic alternatives or strategy that best fit in Bank Islam.

Description

BIMB is providing services to its customers especially in the process of transferring and borrowing the money. BIMB is well-known of the largest and oldest of Islamic bank in Malaysia. BIMB provides services which reflect the significant needs and wants of individuals. Thus, when customers need for a better quality of Islamic bank they will choose BIMB to be their places for getting the services.

In Islamic bank, Riba or also known as interest is prohibited in the business operation. The prohibition of Riba has been replaced by the profit-sharing in the Islamic banking system. The management of Islamic banks based on Islamic Acts and Practices by which the management in the business must follow the practices which required by Islam (Thani, Abdullah, & Hassan, 2003).

Business Segments

According to Kokemuller, business segment is one of the marketing practices to break down large target market into small, more manageable market segments to improve the efficiency of marketing, sales and service (2012). The business segments which BIMB has operated since it was being established until today are:

v Bank Islam Trust Company (Labuan) Ltd

BIMB serve the clients of diverse backgrounds and needs. This segment of business specializes in offshore company formation and management, trust and fund administration. They structure the offshore arrangements according to their customers’ requirements. They build long-term relationships with their clients through the services offered. Besides, this company offer service in formatting and managing a company, provision of trustee, custodian and administration services for investment funds and establishing the fund and fund-related activities.

v BIMB Investment Management Berhad

It was established on 14th September 1993. With the evolution of the Internet in the early 21st century and many people able to manage their own stock, bond and other investments, BIMB has expanded significantly into this sector. A Shariah-compliant Unit Trust is a form of investment scheme which provides a channel for individual and corporate investors who are sharing similar financial objectives such as to pool and invest their monies in a diversified Shariah-compliant portfolio of stocks, sukuk and other Islamic securities. Investors who appoint BIMB Invest agent to undertake investment activities on the behalf of the investor may enjoy all benefits generated by the unit trust fund including the distribution of income and capital appreciation from time to time.

v Al-Wakalah Nominees (Tempatan) Sdn Bhd

Al-Wakalah Nominees (Tempatan) Sdn Bhd was incorporated on 26 June 1984 under the Companies Act 1965. The activity of this company is to act as a nominee for its related companies and other clients by following the Shariah principle. Since it was established until today, the operation in this business segment is wholly handled by BIMB’s staffs. In the year 2001, this segment of business becomes one of the twenty (20) largest shareholders in AIC Corporation Berhad with the percentage of 2.60% which is ranked at 10th position (AIC, 2001). AIC is a semiconductor business who get services from Al-Wakalh Nominees which owned by BIMB.

v Farihan Corporation Sdn Bhd

As BIMB sees the huge market potential and growth for the segment due to increasing popular financing option among small entrepreneurs, this company offer service through BIMB’s new venture which is by establishing Farihan Corporation Sdn Bhd. Farihan Corporation is the Islamic pawn company which provide pawn-broking services or also known as Ar-Rahnu. Thus, it shows the commitment of BIMB to help in financing the small business community, farmers and fishermen. With the presence of current three major Ar-Rahnu players in Malaysia and more than 300 conventional pawnshops established nationwide, it shows and predicts that the growth potential in this industry is high (News: Bank Islam Corporation, 2010).

v Bank Islam Trust Company (Labuan) Ltd

BIMB serve the clients of diverse backgrounds and needs. This segment of business specializes in offshore company formation and management, trust and fund administration. They structure the offshore arrangements according to their customers’ requirements. They build long-term relationships with their clients through the services offered. Besides, this company offer service in formatting and managing a company, provision of trustee, custodian and administration services for investment funds and establishing the fund and fund-related activities.

v BIMB Investment Management Berhad

It was established on 14th September 1993. With the evolution of the Internet in the early 21st century and many people able to manage their own stock, bond and other investments, BIMB has expanded significantly into this sector. A Shariah-compliant Unit Trust is a form of investment scheme which provides a channel for individual and corporate investors who are sharing similar financial objectives such as to pool and invest their monies in a diversified Shariah-compliant portfolio of stocks, sukuk and other Islamic securities. Investors who appoint BIMB Invest agent to undertake investment activities on the behalf of the investor may enjoy all benefits generated by the unit trust fund including the distribution of income and capital appreciation from time to time.

v Al-Wakalah Nominees (Tempatan) Sdn Bhd

Al-Wakalah Nominees (Tempatan) Sdn Bhd was incorporated on 26 June 1984 under the Companies Act 1965. The activity of this company is to act as a nominee for its related companies and other clients by following the Shariah principle. Since it was established until today, the operation in this business segment is wholly handled by BIMB’s staffs. In the year 2001, this segment of business becomes one of the twenty (20) largest shareholders in AIC Corporation Berhad with the percentage of 2.60% which is ranked at 10th position (AIC, 2001). AIC is a semiconductor business who get services from Al-Wakalh Nominees which owned by BIMB.

v Farihan Corporation Sdn Bhd

As BIMB sees the huge market potential and growth for the segment due to increasing popular financing option among small entrepreneurs, this company offer service through BIMB’s new venture which is by establishing Farihan Corporation Sdn Bhd. Farihan Corporation is the Islamic pawn company which provide pawn-broking services or also known as Ar-Rahnu. Thus, it shows the commitment of BIMB to help in financing the small business community, farmers and fishermen. With the presence of current three major Ar-Rahnu players in Malaysia and more than 300 conventional pawnshops established nationwide, it shows and predicts that the growth potential in this industry is high (News: Bank Islam Corporation, 2010).

External factors affecting the industry

There are several external factors which affect the industry of banking. Key external factors that affect industry can be divided into five (5) categories which consist are:

1. Economic forces

Economic forces, in other words, refers to changes in economic trends in the place that may influence the positions of certain companies’ in customers’ minds. The changes may include improved customer service, immediate availability, trouble-free operations of products, and dependable maintenance of products offered. All changes may force BIMB in changing their approaches to deliver banking services to customers. Nowadays, people are more concerned about the quality of services rather than the amount of money they need to pay in order to acquire high-quality services. Changes in economic conditions of the country such as inflation or recession may affect BIMB’s operations, thus, requiring them to find other alternatives in satisfying the needs of their customers, regardless of economic conditions in the places.

2. Social, cultural, demographic and environmental forces

It refers to opportunities and threats that arise from changes in social, cultural, demographic, and environmental variables. All of the forces relates on the way Malaysians live, work, produce, and consume. BIMB also influenced by the factors through services provided to their customer. They provide services that suit the needs of people living in the area. For example, BIMB will provide fast service in Kuala Lumpur due to high traffics of people and required short time usage for each person.

3. Political, governmental and legal forces

Political forces in the statement refer to federal, state, local, and foreign government which act as regulators, deregulators, subsidiaries, employers and customers of organizations. All of the parties play an important role in representing opportunities and threats for the organization. BIMB, in the case, needs to operate under government’s observation and needs to follow all the regulations in the country. Changes in patent law, tax rates, antitrust legislation and lobbying activities can affect the operations of BIMB.

4. Technological forces

Technological forces refer to changes in technology that will give impact to BIMB’s operations. The Internet also one of technological medium applied in most companies all around the world. This is due to the preferences of customers toward changes in technology. BIMB also implement technological forces in their operations to attract customer’s attention and at the same time, provides high-technological services to their customers. The implementation of technology includes ATM machines, e-commerce websites and all transactions in the business used technological appliances.

5. Competitive forces

Competitive forces in the statement indicate the identification of the companies’ rivals in terms of their strengths, weaknesses, capabilities, opportunities, threats, objectives, and strategies. It is essential for every company to evaluate and collect information on their competitors in order to survive in the market. BIMB also devote a long period of time in searching and analyzing their competitor’s strengths and weaknesses to create their competitive advantage over others.

1. Economic forces

Economic forces, in other words, refers to changes in economic trends in the place that may influence the positions of certain companies’ in customers’ minds. The changes may include improved customer service, immediate availability, trouble-free operations of products, and dependable maintenance of products offered. All changes may force BIMB in changing their approaches to deliver banking services to customers. Nowadays, people are more concerned about the quality of services rather than the amount of money they need to pay in order to acquire high-quality services. Changes in economic conditions of the country such as inflation or recession may affect BIMB’s operations, thus, requiring them to find other alternatives in satisfying the needs of their customers, regardless of economic conditions in the places.

2. Social, cultural, demographic and environmental forces

It refers to opportunities and threats that arise from changes in social, cultural, demographic, and environmental variables. All of the forces relates on the way Malaysians live, work, produce, and consume. BIMB also influenced by the factors through services provided to their customer. They provide services that suit the needs of people living in the area. For example, BIMB will provide fast service in Kuala Lumpur due to high traffics of people and required short time usage for each person.

3. Political, governmental and legal forces

Political forces in the statement refer to federal, state, local, and foreign government which act as regulators, deregulators, subsidiaries, employers and customers of organizations. All of the parties play an important role in representing opportunities and threats for the organization. BIMB, in the case, needs to operate under government’s observation and needs to follow all the regulations in the country. Changes in patent law, tax rates, antitrust legislation and lobbying activities can affect the operations of BIMB.

4. Technological forces

Technological forces refer to changes in technology that will give impact to BIMB’s operations. The Internet also one of technological medium applied in most companies all around the world. This is due to the preferences of customers toward changes in technology. BIMB also implement technological forces in their operations to attract customer’s attention and at the same time, provides high-technological services to their customers. The implementation of technology includes ATM machines, e-commerce websites and all transactions in the business used technological appliances.

5. Competitive forces

Competitive forces in the statement indicate the identification of the companies’ rivals in terms of their strengths, weaknesses, capabilities, opportunities, threats, objectives, and strategies. It is essential for every company to evaluate and collect information on their competitors in order to survive in the market. BIMB also devote a long period of time in searching and analyzing their competitor’s strengths and weaknesses to create their competitive advantage over others.

PORTER’S FIVE FORCES ANALYSIS

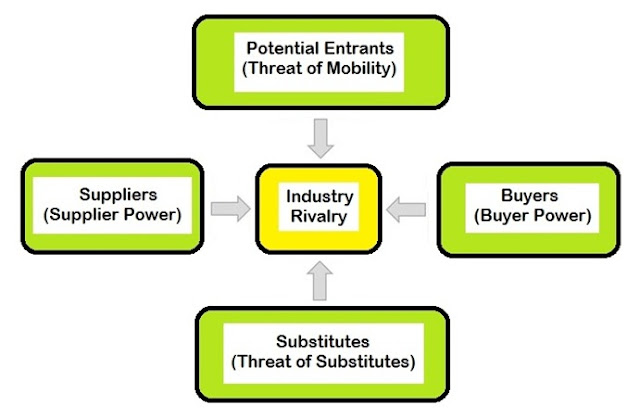

Figure 1: Porter’s Five Forces Model

Porter’s Five Forces Model of competitive analysis is widely used to develop strategies in many industries. The model is shown in the above figure which consists of bargaining power of buyers, bargaining power of suppliers, potential entrants of new company and substitutes of a new product.

v Rivalry among Competing Firms

It is the most powerful of the five competitive forces. The intensity of rivalry among competing firms tends to increase as the number of competitors increases. Besides BIMB, there are a lot of banks which offer services based on Islamic principles such as Maybank Islamic, CIMB Islamic and others. Besides, rivalry in BIMB also increase when the consumer easily switch the brand. They might switch from BIMB to other firms such as Maybank Islamic, CIMB Islamic, Affin Bank Islamic and others.

v Potential Entry of New Competitors

When a new firm can easily enter an industry, the intensity of competitiveness among firms will be increased. News firms sometimes enter industries with high-quality products, lower prices and substantial marketing resources. BIMB face many new entrants of Islamic bank such as the entrant of Bank Muamalat Sdn Bhd.

v Potential Development of Substitute Products

Competitive pressures arise from substitute products increase as the relative price of substitute products declines and as consumers’ switching cost decrease. The introduction of internet banking will impact the uses of banking operation manually. This means customers tend to change their behaviour. Instead of going to BIMB’S branches to do some transaction or transferring money, they use the internet from their office or home in order to do the transaction activities.

v Bargaining Power of Suppliers

The bargaining power of suppliers affects the intensity of competition in the industry. A large number of suppliers, a few substitute raw materials and high switching cost influence the bargaining power of suppliers. Since there are few suppliers besides BIMB, the bargaining power of suppliers in BIMB is high. This means the company have the power to set their product prices without being controlled by others.

v Bargaining Power of Buyers

The bargaining power of buyer will affect the intensity of competition in an industry when customers are buying the products in large volume. The bargaining power of buyers will also increase when the products offered are standardized and undifferentiated. Since BIMB provides a little bit similar services with other banks can offer their customers have the high bargaining power of buyers. The customers have the power to choose which company they are interested to get services.

CRITICAL SUCCESS FACTORS FOR INDUSTRY

v Internal factors

Internal factors provide the critical success factors for the banking industry. The internal factors consist of departments within the organization such as marketing, finance, operation and human resource departments. Marketing department in BIMB plays important roles in providing the advertisement to their new and potential customers. They can place the advertisement in the newspaper and through the website. When the customers view the promotion, they might attract to use services provided by BIMB.

Besides, the department of human resource (HR) also plays important roles in providing better service to their customers. This is because the people in HR Department are the respective people who take in charge of hiring and training new employees in the company. They can increase the quality service of employees if they give sufficient training to the employees before they can be placed in the office of a company.

v Competitors factor

Competitors’ factors also become one of the critical success factors for the industry. The factors are coming from the competitors themselves. If the competitors reduce the price of products and services, a company need to make a decision whether they can reduce the price or maintain the price but improve their quality of products or services. Thus, by comparing with competitors a company can do benchmarking. This will also improve their performance in providing services to customers.

If a company just ignore what its competitors do in promoting their companies, another company will face difficulty in getting new customers. This is because people nowadays are seeking for a company which can provide them better service so that they will feel worth in paying for the services. For example, in banking industry, people are seeking banks which can provide them with faster and friendly service. Besides, they seek banks which they can put their trust in them.

CURRENT SITUATION OF FIRM

Mission

Mission is important key to business success. There are several missions of Bank Islam Malaysia Berhad (BIMB) which are:

- To continually develop and innovate universally accepted financial solutions in line with Shariah Principles

BIMB is a bank which practices Shariah principle in the transaction process. Every transaction is based on Islamic principles such as there is no involvement interest or ‘Riba’ is the transaction. Thus, it will be fair for the customers and bank itself because there is no interest imposed on the customers and their investors will get the profit or loss gain by the company equally and fairly.

- To provide a reasonable and sustainable return to shareholders

BIMB want to provide a reasonable and sustainable return to its shareholders. This is to attract more investors for outside to invest in the company.

- To provide for a conducive working environment and to become an ‘Employer of Choice’ for top talents in the market

BIMB want to provide the working environment which is conducive to their employees so that their employees will be motivated in doing their job and can be more creative in making a decision. BIMB also want their company to be the best choice for top talents from graduated students or people with better skills in the market.

- To deliver comprehensive financial solutions to global standards using state-of-the-art technology

BIMB want to deliver good services to fulfil their customers’ need such as by introducing an online banking transaction. This means customers can solve their financial problems without spending much time going to the branches of BIMB.

- To be a responsible and prudent corporate citizen

BIMB want to hold responsibility and become the prudent corporate citizen by becoming the trusted bank. BIMB want their employees to be honest with their customers during the transaction and transferring money processes.

Vision

“To Be a Global Leader in Islamic Banking”

This vision of BIMB shows that they want to be the leader in Islamic banking globally. Global leader in this vision means that they want to be the ultimate guidance and source of reference for innovative Shariah-based products and services.

Core Brand Values

v A Leader

BIMB wants their Islamic products are the benchmark by other banking companies and reputed as the pioneer in Islamic banking. BIMB want to give a hand in building the Islamic banking industry.

v Dynamic

BIMB want to become a company which is a progressive and innovative company. They have constantly moved ahead as they offer new and technologically advanced products and services.

v Professional

The services which are being provided by BIMB are fast, efficient and responsive services. They are knowledgeable and equipped to handle global business challenges.

v Caring

BIMB has approachable employees and supportive partner to help the customers in fulfilling their customers’ financial needs.

v Trustworthy

BIMB is a bank which is trustworthy. Their customers can depend and rely on them when keeping, storing and transferring their money. This is because BIMB provides only 100% Shariah-based products, services and corporate values.

Porter’s Generic Strategy

According to Porter, strategies allow organizations to gain competitive advantage from three different bases which are cost leadership, differentiation and focus. Cost leadership emphasis producing standardized products at a very low per-unit cost for consumers who are price sensitive. Differentiation is a strategy aimed at producing products and services considered unique industry-wide and directed at consumers who are relatively price-insensitive. Focus means producing products and services that fulfil the needs of small group of consumers.

As for BIMB, this company offers services at the best price value to a wide range of customers in Malaysia. BIMB offers services to people in Malaysia with the majority of Muslim as the customers by following Shariah principles.

According to above figure, Type 1 is cost leadership with low cost, Type 2 is cost leadership with the best value, Type 3 is differentiation, Type 4 is the focus with low cost and Type 5 is focus with the best value.

BIMB is using Type 2 which is Cost leadership with the best value. BIMB which employing best value (Type 2) cost leadership strategy must achieve their competitive advantage in ways those are difficult for competitors to copy or match.

EXTERNAL ENVIRONMENT (OPPORTUNITIES AND THREAT)

External Factor Evaluation (EFE) Matrix refers to the strategic management tool that often used by companies in assessing current business conditions. The EFE Matrix is normally used in visualizing and prioritizing the opportunities and threats faced by the business. It is similar to Internal Factor Evaluation (IFE) Matrix which only differs based on factors included in the model. EFE Matrix deals with external factors such as social, economic, political, legal and other external factors, while IFE Matrix focuses on internal factors.

The EFE Matrix can be developed under five (5) steps:

1) List key external factors as identified in the research phase, including opportunities and threats.

2) Assign to each variable weight that ranges from 0.0 (not important) to 1.0 (very important). The weight will show the importance of factors in companies’ success.

3) Assign rating between 1 until 4 to each factor that indicates the effectiveness of firms in responding to the factors. The rating starts with 4 = response is superior, 3 = response is above average, 2 = response is average and 1 = response is poor.

4) Multiply each weight with the rating to determine the weighted score.

5) Sum the weighted score to determine the total weighted scores for the companies. There are several external environments which affect the firm especially in term of opportunities and threat in industry.

1) List key external factors as identified in the research phase, including opportunities and threats.

2) Assign to each variable weight that ranges from 0.0 (not important) to 1.0 (very important). The weight will show the importance of factors in companies’ success.

3) Assign rating between 1 until 4 to each factor that indicates the effectiveness of firms in responding to the factors. The rating starts with 4 = response is superior, 3 = response is above average, 2 = response is average and 1 = response is poor.

4) Multiply each weight with the rating to determine the weighted score.

5) Sum the weighted score to determine the total weighted scores for the companies. There are several external environments which affect the firm especially in term of opportunities and threat in industry.

Opportunities

|

Weight

|

Rating

|

Weighted Score

|

Expanding into ASEAN market

|

0.16

|

4

|

0.64

|

Increase in economic activities

|

0.12

|

2

|

0.24

|

Encouragement by government

|

0.11

|

2

|

0.22

|

Internet and communication technologies (e-commerce)

|

0.20

|

4

|

0.80

|

Threats

|

|||

Fake website

|

0.19

|

4

|

0.76

|

Increase in entrants of new Islamic Bank

|

0.13

|

3

|

0.39

|

Changes in lifestyle

|

0.09

|

2

|

0.18

|

TOTAL

|

1.00

|

3.23

|

The figure above shows the EFE Matrix analysis of BIMB which indicates the opportunities and threats in the banking industry.

Opportunities

There are opportunities that existed in the banking industry which includes expansion into the ASEAN market. Many companies rarely expand into the ASEAN market especially local bank, thus creating opportunities for BIMB in the market. This variable is less important due to a low weight of 0.16 while having a high response from BIMB on the factor. Other than that, the increments of economic activities also act as one of BIMB’s opportunities in the market. There are many new companies established and needs to apply for the loan. Therefore, BIMB plays an important role in providing a loan without the concept of ‘Riba’. The factor is less important thus the first one (weight = 0.12), as they assume that new companies will not survive in the market for a long time. According to the EFE Matrix analysis, the response of BIMB towards the factor is average with ratings of 2 (response is average).

Besides that, encouragement by the government also become another opportunity of BIMB as Malaysian Government encourages Islamic– a type of business. The factor is less important with the weight of 0.11 and a rating of 2 which indicates the average response of BIMB in dealing with the opportunities. Internet and communication technologies (e-commerce) is another opportunity for BIMB that is included in the analysis. The factor is less important as well based on its weight of 0.20, which is slightly greater than others but still did not reach the average. However, the response of BIMB toward the opportunities is superior due to the high rating of 4.

There are four (4) opportunities that BIMB can look after for their long-term business. The opportunities that BIMB can get are:

1. Expanding into ASEAN market

For the banking industry, BIMB is looking forward to expanding their business to ASEAN market. This is because of it in accordance with their vision which is to be a global leader in Islamic banking. For BIMB, in order to penetrate the market and become a leader in the Islamic banking industry, they need to search for a chance to expand their market internationally. For example, they can do a joint venture with other banks in foreign countries such as in Australia, South Korea and other countries so that BIMB can be recognized by the people all around the world.

2. Encouragement by Government

With the encouragement from the government by increasing the awareness toward Islamic banks had to give opportunities for BIMB to increase their market growth and market penetration. Besides, by reducing the taxes imposed on the bank industry had encouraged BIMB to offers more products and services to its customers. The government also play important roles in influencing companies in the business industry to increase their percentages of market shares in Malaysia. Thus, by taking this opportunity BIMB can hold the largest market share in Malaysia and finally become the leader in the Malaysian banking industry.

3. Increase in economic activities

With the increase in economic activities such as the increasing number of business company establish and project for construction to be implemented, the number of loans applied by business people will increase. This is because in order to set up the business people need large capital which only can be received from the loan applied to the bank. Thus, it will become the opportunities for BIMB to increase its market share. Nowadays there is a lot of construction has been made in order to change Malaysia from a developing country to a developed country. Therefore, BIMB grabs this opportunity to provide loans to bigger and well-established company with special services those others banks cannot offer to them.

4. Internet and communication technologies (e-commerce)

Nowadays technologies are changing faster than before. It is goods opportunity for BIMB to provide the best service through the internet. With the high level of people awareness toward the uses of the internet, they can access BIMB’s website to do the transaction or transferring money from and into their accounts. Currently, people have fully utilized the presence of internet and communication technologies. Thus, with this level of awareness from the customers BIMB can get opportunities to provide more services to the people who seek for their services. BIMB provide convenience to people by introducing internet banking and mobile banking.

1. Expanding into ASEAN market

For the banking industry, BIMB is looking forward to expanding their business to ASEAN market. This is because of it in accordance with their vision which is to be a global leader in Islamic banking. For BIMB, in order to penetrate the market and become a leader in the Islamic banking industry, they need to search for a chance to expand their market internationally. For example, they can do a joint venture with other banks in foreign countries such as in Australia, South Korea and other countries so that BIMB can be recognized by the people all around the world.

2. Encouragement by Government

With the encouragement from the government by increasing the awareness toward Islamic banks had to give opportunities for BIMB to increase their market growth and market penetration. Besides, by reducing the taxes imposed on the bank industry had encouraged BIMB to offers more products and services to its customers. The government also play important roles in influencing companies in the business industry to increase their percentages of market shares in Malaysia. Thus, by taking this opportunity BIMB can hold the largest market share in Malaysia and finally become the leader in the Malaysian banking industry.

3. Increase in economic activities

With the increase in economic activities such as the increasing number of business company establish and project for construction to be implemented, the number of loans applied by business people will increase. This is because in order to set up the business people need large capital which only can be received from the loan applied to the bank. Thus, it will become the opportunities for BIMB to increase its market share. Nowadays there is a lot of construction has been made in order to change Malaysia from a developing country to a developed country. Therefore, BIMB grabs this opportunity to provide loans to bigger and well-established company with special services those others banks cannot offer to them.

4. Internet and communication technologies (e-commerce)

Nowadays technologies are changing faster than before. It is goods opportunity for BIMB to provide the best service through the internet. With the high level of people awareness toward the uses of the internet, they can access BIMB’s website to do the transaction or transferring money from and into their accounts. Currently, people have fully utilized the presence of internet and communication technologies. Thus, with this level of awareness from the customers BIMB can get opportunities to provide more services to the people who seek for their services. BIMB provide convenience to people by introducing internet banking and mobile banking.

Threats

The threat also being discussed in the analysis which includes fake website made by hackers or internet criminal in acquiring a large amount of money when customers make a transaction on the website. The threat is less important due to its weight of 0.19 while having superior responses from BIMB (ratings = 4). BIMB has taken many alternatives in solving the problems of fake website, thus, having high security in online transactions.

Furthermore, a high number of entrants from new Islamic Bank creates a threat to BIMB. The weight of factor is 0.13 and indicates the low importance of the factor in BIMB. However, the response of the bank on the threat is above average due to its rating of 3. Changes in lifestyle also contribute to BIMB’s threats with the weight of 0.09 (less important) and average response of BIMB to the threat (ratings = 2). A total weighted score of 3.23 indicates that BIMB is responding to opportunities and threats in an outstanding way due to its total weighted score located near the maximum number of 4.0.

There are three (3) threats that BIMB can look face in the banking industry. The threats that BIMB need to face are:

1. Duplicate Website

Because of the presence of technologically advanced, the number of hackers also increases. Thus, it will bring problems to banks such as BIMB which are using internet banking as one of their service providers. The hackers might duplicate the website and get money when people do the transaction through the banks’ website. Thus, BIMB will face it as a threat because their website might be hacked by unauthorised people illegally and BIMB might face a high amount of loss.

2. High Number of Entrants of Islamic Banks

With the high number of entrants of Islamic banks, BIMB faces difficulty in getting new customers especially if the new banks offered better services to their customers. Thus, it will bring threat to BIMB in order to get new customers and retain the existing customers.

3. Changes in Lifestyle

With the changes of lifestyle as people following the latest of technology, BIMB might face difficulty in targeting its customers. This is because their customers who are seeking for service that are convenient and easy to use might choose other banks which can provide the services with implementation of high technology systems.

1. Duplicate Website

Because of the presence of technologically advanced, the number of hackers also increases. Thus, it will bring problems to banks such as BIMB which are using internet banking as one of their service providers. The hackers might duplicate the website and get money when people do the transaction through the banks’ website. Thus, BIMB will face it as a threat because their website might be hacked by unauthorised people illegally and BIMB might face a high amount of loss.

2. High Number of Entrants of Islamic Banks

With the high number of entrants of Islamic banks, BIMB faces difficulty in getting new customers especially if the new banks offered better services to their customers. Thus, it will bring threat to BIMB in order to get new customers and retain the existing customers.

3. Changes in Lifestyle

With the changes of lifestyle as people following the latest of technology, BIMB might face difficulty in targeting its customers. This is because their customers who are seeking for service that are convenient and easy to use might choose other banks which can provide the services with implementation of high technology systems.

INTERNAL ENVIRONMENT (STRENGTHS AND WEAKNESSES)

IFE Matrix refers to Internal Factor Evaluation Matrix refers to the strategic management tool that are well-known to be used for audit or evaluate the internal strength and internal weaknesses of a company or business. The firm’s internal strength and weaknesses in the statement include management, marketing, financial or accounting, production or operations, research and development and computer information system. IFE Matrix is normally used in strategy formulation of the business or companies. The Matrix consists of factors (strength and weaknesses), weight (0.0 to 1.0), rating (0.0 to 4.00) and its weighted score after multiplying weight with its ratings.

There are five (5) steps in developing IFE Matrix:

- List key internal factors as identified in the internal audit process. Use a total of from 10 to 20 internal factors, which include both strength and weaknesses. The strengths need to be listed first and followed by its weaknesses.

- The weight that ranges from 0.0 (not important) to 1.0 (all-important) needs to be assigned to each factor. The weight indicates the importance of factor to being successful in the firm’s industry. The sum of all weights must be equal to 1.0.

- Assign 1–to–4 rating to each factor in indicating whether the factor represents major weaknesses (ratings=1), minor weaknesses (ratings=2), minor strength (ratings=3), or major strength (ratings=4). Strengths must receive ratings of 3 or 4, while weaknesses receive ratings of 1 or 2.

- Each factor’s weight must be multiplied with the rating to determine its weighted score.

- Sum all weighted scores to determine the total weighted scores for the organization.

Strengths

|

Weight

|

Rating

|

Weighted Score

|

Mobile and online banking

|

0.20

|

4

|

0.80

|

High number of ATM BIMB

|

0.13

|

3

|

0.39

|

High R&D

|

0.12

|

3

|

0.36

|

Wide area of services

|

0.05

|

2

|

0.10

|

Weaknesses

|

|||

Limited to one segment

|

0.15

|

4

|

0.60

|

Ineffective public dealing

|

0.12

|

3

|

0.36

|

Employee’s attitude toward customer

|

0.13

|

3

|

0.20

|

Poor condition of technology

|

0.10

|

2

|

0.20

|

TOTAL

|

1.00

|

3.20

|

According to IFE (Internal Factor Evaluation) analysis of BIMB as pictured in the diagram, strengths and weaknesses of BIMB can be identified.

BIMB portray numerous strengths which comprise of mobile and online banking in its operations. There is a small amount of bank in Malaysia that involves in mobile and online banking that prove to be an advantage to them. This variable is considered important due to its weights of 0.20 and major strength in BIMB due to its rating of 4. Other than that, BIMB also provides a high number of ATM machines which aid customers during transactions of money and reduce their time to get or keep money in their account. This variable is less important than the first strength due to less weight of 0.13 while acting as the minor strength of the bank (rating = 3). A high number of R & D also acts as one BIMB’s strengths.

BIMB has conducted research on how to improve the services provided to their customers and at the same time encourage Muslim to use their services. This strength is less important based on its weight of 0.12 and minor strength of the bank (rating = 3). BIMB’ strengths also included a wide area of services that they provided to their customers. People can found BIMB outlets almost in all places due to the company’s attention in providing services to their customers in any time at every place. This is the less important strength because of its lowest weight at 0.05 with ratings of 2 that show its less strength in BIMB.

BIMB has conducted research on how to improve the services provided to their customers and at the same time encourage Muslim to use their services. This strength is less important based on its weight of 0.12 and minor strength of the bank (rating = 3). BIMB’ strengths also included a wide area of services that they provided to their customers. People can found BIMB outlets almost in all places due to the company’s attention in providing services to their customers in any time at every place. This is the less important strength because of its lowest weight at 0.05 with ratings of 2 that show its less strength in BIMB.

On the other side, BIMB also has their own weaknesses which include limited to one segment only. This becomes the major weakness to BIMB as they only focus on banking only and does not expand their scope of business such as developing properties and others. Its weight is 0.15 that show less importance of the factors while acting as the strongest weaknesses towards BIMB (ratings = 4). In addition, BIMB also faced weakness of ineffectiveness in dealing with the public. They do not have sufficient information in making promotion to the public and at the same time reduce their abilities to attract attention from their customers. The weight is 0.12 slightly lower than the first factor showing less importance in BIMB with the rating of 3 which indicates strong weaknesses to the company. Employees’ attitude towards customer also contributes toward BIMB’s weaknesses with the weight of 0.13 (less important) and ratings of 3 that show strong weaknesses of the factor towards BIMB. The last weakness is poor condition of technology implemented in BIMB’s operations. It is considered less important due to the weight of 0.10 and minor weakness with ratings of 2.

The total weighted score of BIMB indicates 3.20 which shows that BIMB have a strong internal position as their strengths can cover their weaknesses and still have the competitive advantage over others.

There are several strength and weaknesses that BIMB has when performing its operation in the company.

Strengths

1. Mobile and Online Banking

Nowadays, many consumers are interested in conducting business over the internet either selling of used goods or buying products. Therefore, they need to have a credit card in order to make payment to another party. This will lead to strength of BIMB due to its low interest of credit card provided to their customers.

2. High number of ATM BIMB

Other than that, BIMB also provided many ATM machines all over the countries to ease the transaction of money by customers. They only need to use their ATM card and reduce the time spent through queuing and undergoes procedures in the bank itself. The high number of ATM BIMB will increase customer’s loyalty towards BIMB and at the same time become one of its strengths.

3. High R&D

Besides, BIMB also involves in R&D (research and development) to improve their services’ quality provided to their customers. They continuously make a research regarding the banking industry and search for alternatives that will provide a highly competitive advantage to them. High research and development made become one their strength over others.

4. Wide Coverage Area of Services Provides

BIMB also provide a wide coverage area of services by placing their outlets in all states with additional ATM machines. This is essential in showing their strength of providing services of BIMB at all places regardless of places. Some banking companies choose a certain place to build their outlets to reduce expenses. However, BIMB place customers as their priority and not their revenues. Thus, it becomes the strength of BIMB to gain customers loyalty.

Weaknesses

1. Limited to one segment

BIMB also faces weakness on limited segment provided. This is because BIMB only involves in banking transaction without participation in other segments such as properties or sales. BIMB only provides services in financial purpose and not providing other services or products such as services that related to airlines or travel agency. This will affect BIMB in the competition with another Islamic Bank.

2. Ineffective public dealing

Besides, BIMB also lacks effectiveness in dealing with the public. The employees spent their time in the offices and deal with customers personally. However, they are not involved in any promotion or events and will affect their skills in dealing with the public in future time. Customers will have a bad perception of BIMB’s staffs due to their ineffectiveness in dealing with the public.

3. Employee’s attitude toward customer

Some customers even make a complaint regarding employees’ attitude towards the customer. Some of them may speak harshly and shows little respect to their customers. This becomes a weakness of the operations in BIMB. Customers preferred services provided with good attitudes and at high speed without wasting their time to wait for the employees in preparing the documents for a long time.

4. Poor condition of technology

The technology used in BIMB is easily broken down and take a long time to repairs especially regarding their ATM machines. This will become an inconvenience to their customers especially when they are in a hurry. The poor condition of technology also acts as their weaknesses due to high customer’s needs towards technological products.

FIRM CRITICAL SUCCESS FACTORS

SWOT

SPACE Matrix

Conclusion:

ES Average is -9 ÷ 3 = -3.00

IS Average is 11 ÷ 3 = 3.67

CA Average is -10 ÷ 3 = -3.33

FS Average is 5 ÷ 2 = 2.50

Directional Vector Coordinated:

x-axis: -3.33 + (+3.67) = +0.34

y-axis: -3.00 + (+2.50) = -0.5

BIMB should pursue Competitive Strategies which is by doing market penetration, market development and product development.

BCG

Division

|

Revenues

|

Percent Revenues

|

Profits (RM)

|

Percent Profits

|

Relative Market Share

|

Industry Market Growth

|

1

|

480, 235

|

39%

|

285, 324

|

45%

|

0.45

|

+15

|

2

|

350, 320

|

28%

|

151, 762

|

24%

|

0.25

|

+10

|

3

|

258, 765

|

21%

|

113, 934

|

18%

|

0.20

|

+10

|

4

|

150, 784

|

12%

|

85, 645

|

13%

|

0.10

|

+10

|

TOTAL

|

1, 240, 104

|

636, 665

|

1.00

|

Division 1 – Bank Islam Trust Company (Labuan) Limited

Division 2 – BIMB Investment Management Berhad

Division 3 – Al- Wakalah Nominees (Tempatan) Sdn Bhd

Division 4 – Farihan Corporation Sdn Bhd

Relative market Share:

= 0.84

Industry Market Growth:

= (This Year Revenues – Last Year Revenues) / Last Year Revenues

= (1,666,313 – 2,187,989) - 2,187,989

= -0.24

PROBLEMS FACING THE FIRM

There are some problems facing by BIMB as an Islamic bank in Malaysia. The problems faced by BIMB starting from its first establishment and some remain still unsolved. The problems may range from its operations, services provided and security when conducting transactions with their customers.

v Operations of BIMB

BIMB faced major problem especially in its operations. The problem includes transaction of money that is insufficient as demanded and managers that the employees’ may be untrustworthy and started to investigate the cases of money loss. However, after few years the problem still existed and top management of BIMB devote a lot of time in searching for ways to stop the money loss.

v Services provided

Customers tend to make comparisons on services provided by the bank to them. This will caused major problems in terms of services provided by BIMB due to their comparisons. When this happen, customers will assume that BIMB’s services cannot reach standards of bank in Malaysia and at the same time affects BIMB’s image in customers minds.

v Security Management of BIMB

Many companies especially involve in financial institutions such as bank faced problem of security during any business transactions especially on internet. This becomes one of the problems faced by BIMB when conducting their banking operations. As technology starts to become more advanced, the hackers that have expertise in creating fake website will rise and reduce number of customer that involves in e-commerce of BIMB.

v Operations of BIMB

BIMB faced major problem especially in its operations. The problem includes transaction of money that is insufficient as demanded and managers that the employees’ may be untrustworthy and started to investigate the cases of money loss. However, after few years the problem still existed and top management of BIMB devote a lot of time in searching for ways to stop the money loss.

v Services provided

Customers tend to make comparisons on services provided by the bank to them. This will caused major problems in terms of services provided by BIMB due to their comparisons. When this happen, customers will assume that BIMB’s services cannot reach standards of bank in Malaysia and at the same time affects BIMB’s image in customers minds.

v Security Management of BIMB

Many companies especially involve in financial institutions such as bank faced problem of security during any business transactions especially on internet. This becomes one of the problems faced by BIMB when conducting their banking operations. As technology starts to become more advanced, the hackers that have expertise in creating fake website will rise and reduce number of customer that involves in e-commerce of BIMB.

STRATEGIC ALTERNATIVES OR STRATEGY THAT BEST FIT YOUR FIRM

Every problem has its own solution. This shows that, all problems faced by BIMB can be solved with the alternatives existed around people and in the banking industry itself. Some of the alternatives to solve the problems faced by BIMB includes:

v Examine all transactions

The major problems which arise in BIMB are all businesses involved with money. Therefore, top management which is trustworthy and nominated needs to be put in charge of any transactions involving large amount of money. In this way, the money loss will be reduced and if the loss still occurs, the culprit will be easily reprehended. This methods rarely adapted by banking company as the amount of money loss either large or small are thought as trivial and did not required solutions as the problems always occur.

v Research and development (R&D)

Besides, the problem can be solved through further research made by BIMB employees’ regarding the matter. If the services provided still did not reach the expectation of customers, BIMB need to make further research regarding latest trends, quality of services demanded as well as their competitor’s services. Through analyzing every aspect, quality of services provided by BIMB can be improved and creates a good image in customer’s minds.

v Increase security of e-commerce

Nowadays, many banks' websites have been duplicate by internet criminal to earn money. Therefore, BIMB needs to increase the security of their website through displaying their full website in BIMB’s outlets and encourage strong password in accessing their accounts over internet. Through increasing the security of their website, customers will feel at ease when using the services especially over internet. This will also increase customer’s loyalty towards BIMB and will feel content on BIMB’s security compare to other banking companies.

v Examine all transactions

The major problems which arise in BIMB are all businesses involved with money. Therefore, top management which is trustworthy and nominated needs to be put in charge of any transactions involving large amount of money. In this way, the money loss will be reduced and if the loss still occurs, the culprit will be easily reprehended. This methods rarely adapted by banking company as the amount of money loss either large or small are thought as trivial and did not required solutions as the problems always occur.

v Research and development (R&D)

Besides, the problem can be solved through further research made by BIMB employees’ regarding the matter. If the services provided still did not reach the expectation of customers, BIMB need to make further research regarding latest trends, quality of services demanded as well as their competitor’s services. Through analyzing every aspect, quality of services provided by BIMB can be improved and creates a good image in customer’s minds.

v Increase security of e-commerce

Nowadays, many banks' websites have been duplicate by internet criminal to earn money. Therefore, BIMB needs to increase the security of their website through displaying their full website in BIMB’s outlets and encourage strong password in accessing their accounts over internet. Through increasing the security of their website, customers will feel at ease when using the services especially over internet. This will also increase customer’s loyalty towards BIMB and will feel content on BIMB’s security compare to other banking companies.

RECOMMENDATION

As a recommendation, BIMB should improve the product development in order to provide a various type of products and services to their customers. This company should not focus only at one segment which is financial segment but also other segments. This company should expand their product segment and introduce more new products or services which the competitors cannot offers to the customers. Besides, BIMB need to penetrate the market. They need to take some action in order to improve their performance so that they can offer the best services to customers in other countries too. BIMB can achieve their vision to be the global leader in Islamic Banking and can be the first to penetrate the Asean market before they can enter the European market. Several strategies can be taken in order to compete with their nearest competitors such as Maybank Islamic, CIMB Islamic, Affin Bank Islamic and others. In addition, BIMB need to focus on their internal and external environment factors which includes the opportunities and threat facing by BIMB in the banking industry and the take into account about the strengths and weaknesses within the firm. Several critical success factors also can help BIMB in increasing its market share and market growth by comparing with the largest competitor that they face.

REFERENCES

AIC. (2001). Statistics of Shareholdings. Kuala Lumpur: AIC Corporation Berhad.

Kokemuller, N. (2012). Market Segments for Banking Industry. Retrieved from Chron Web site: http://smallbusiness.chron.com/market-segments-banking-industry-14390.html

News: Bank Islam Corporation. (2010, April 8). Retrieved from Bank Islam Web site: http://www.bankislam.com.my/en/news/Pages/Bank%20Islam%20To%20Start%20Islamic%20Pawn-Broking%20Services.aspx

Thani, N. N., Abdullah, M. R., & Hassan, M. H. (2003, January 24). Law and practice of Islamic Banking and Finance. Selangor: Sweet and Maxwell Asia. Retrieved from UAE Web site: http://ilovetheuae.com/2011/01/24/bank-islam-malaysia-berhad-bimb-and-bank-muamalat-malaysia-berhad-bmmb/

UAE. (2011, January 24). UAE Laws and Islamic Finance. Retrieved from UAE Web site: http://ilovetheuae.com/2011/01/24/bank-islam-malaysia-berhad-bimb-and-bank-muamalat-malaysia-berhad-bmmb/